The longer estimates sit, the less likely they close. But who should own the follow-up: Service Professionals? CSRs? GMs? Inside sales teams?

By the time a customer says "let me think about it," you've already spent real money.

You paid for the lead—$150, $300, maybe more depending on the source. You sent a service professional to the home—that's an hour of labor, plus drive time, plus truck costs. You tied up a slot on the schedule that could have gone to a paying job. All in, you might have $400-600 invested in that single opportunity before anyone pulls out a quote.

And then it doesn't close. Not because the customer said no. Not because they went with a competitor. They just... didn't decide.

"Let me talk to my spouse."

"We need to think about it."

"Can you send me the quote?"

Now what?

Contact rates drop significantly after the first 24-48 hours, and continue to decay from there. Yet in most shops, there's no clear owner of the follow-up process, no system for handoffs, and no visibility into what's actually happening. Estimates age in the CRM. The investment you already made goes to zero. Revenue that should have closed quietly disappears.

The question isn't whether to follow up. It's who, when, and with what information.

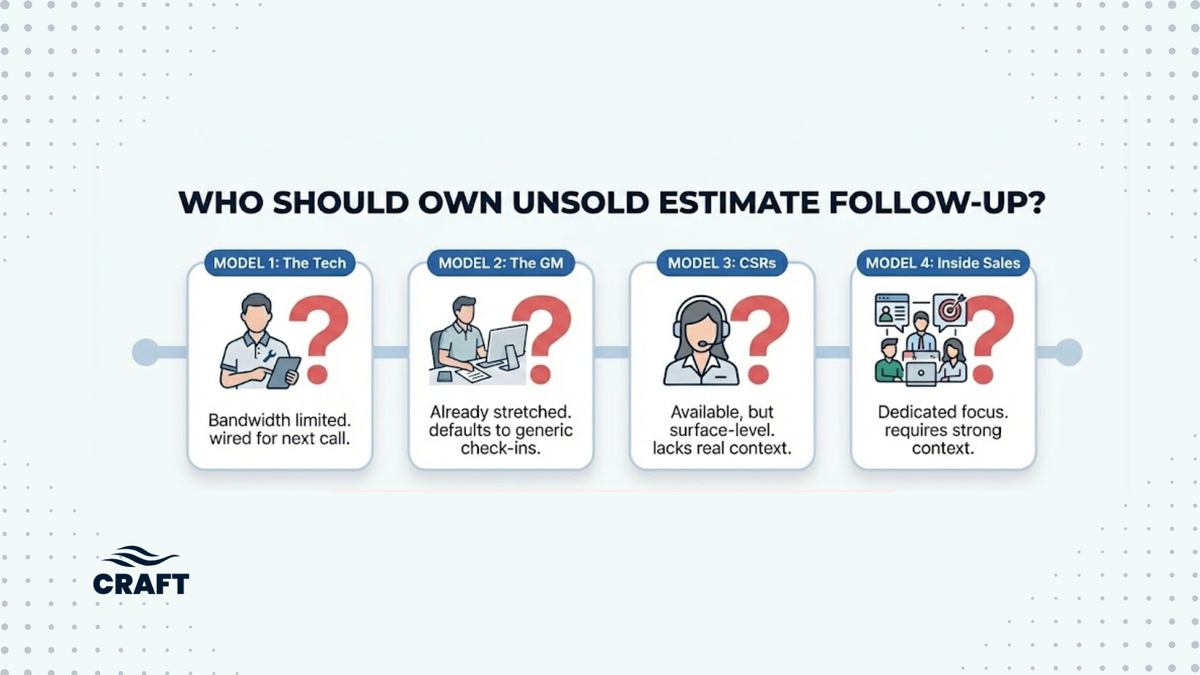

The Four Models

Most operators land somewhere in one of four approaches—each with real tradeoffs.

Model 1: The Tech or Comfort Advisor Owns It

The logic makes sense. The tech or comfort advisor was in the home. They built the rapport. They know what the customer cared about, what objections came up, whether the spouse was on board, and which options the customer was most interested in.

The problem: techs and comfort advisors are in the field. They're not sitting at a desk making follow-up calls between appointments. Some will text from the truck. Most won't. They're wired to run the next call, not chase the last one.

Some shops try to enforce it through compensation: "You don't get credit unless you close it." Others give the tech exclusive ownership for a set period—48 hours, 7 days—before the lead moves to someone else. But even with accountability structures in place, the tech has limited bandwidth. If they're running 4-5 calls a day, follow-up becomes an afterthought. Context degrades. Leads rot.

When it works: Small shops where the tech is also the closer. Owner-operators who live and die by every estimate. Short ownership windows (24-48 hours) with a clear handoff process.

Common mistakes: No defined ownership period—"the tech owns it" forever, which means nobody owns it. No system for tracking follow-up activity. No handoff process when the tech doesn't close.

Model 2: The GM or Owner Owns It

This is the "I'll just do it myself" model. The GM or owner cares more than anyone about every dollar, so they take on the follow-up personally.

The problem: they're already stretched. They're managing operations, putting out fires, dealing with staffing, handling escalations. Follow-up becomes one more thing on a list that's already too long.

And when they do call, they're calling blind. They weren't in the home. They don't know what financing options were discussed, what the customer's real hesitation was, or who else was involved in the decision. They might have CRM notes—"quoted 16 SEER, $12,400"—but that's not enough to have a real conversation.

The call becomes: "Hey, just checking in on that estimate we sent over..." The customer says, "Still thinking about it." The GM says, "Okay, let us know if you have questions." Nothing moves.

When it works: Very small shops where the owner is still in the field. High-value estimates that warrant personal attention from leadership. As a backup when other systems fail.

Common mistakes: Trying to do it all personally instead of building a system. Calling without context and defaulting to generic check-ins. Letting follow-up slip when operations get busy (which is always).

Model 3: CSRs Make "Happy Calls"

Some operators route unsold estimates to the call center. CSRs check in a few days after the appointment—ostensibly to ask about the customer's experience, but really to nudge them toward a decision.

This model has advantages: CSRs are already on the phones, they're available during business hours, and it's easy to systematize. You can build it into existing workflows without adding headcount.

The problem: CSRs weren't in the home. They're reading from a script or a CRM note. They don't know the customer was worried about the monthly payment. They don't know the husband wanted to wait until after the holidays. They don't know the comfort advisor spent 20 minutes talking through financing options and the customer was leaning toward the mid-tier system before their spouse raised concerns.

Without that context, the conversation stays surface-level. "Just calling to see if you had any questions about your estimate." The customer gives a polite non-answer. The CSR marks it as "contacted" and moves on.

When it works: Simple reminders for customers who just need a nudge. Appointment confirmations and rescheduling. Initial check-ins before a more substantive follow-up.

Common mistakes: Treating CSR happy calls as a replacement for real sales follow-up. Not giving CSRs any context beyond basic CRM data. Scripting calls so tightly that they feel robotic.

Model 4: Centralized Inside Sales

A growing number of operators—especially larger ones, multi-location platforms, and PE-backed groups—are building dedicated inside sales teams to own estimate follow-up. This mirrors what home improvement companies (windows, roofing, remodeling) have done for years.

The advantages are real: dedicated headcount, full-time focus, clear accountability, and the ability to scale across locations. An inside sales rep whose only job is closing unsold estimates will put in more touches, with more consistency, than a tech or GM juggling a dozen other priorities.

This model also creates operational leverage. Instead of relying on 20 techs to each follow up on their own estimates, you're centralizing the function with 2-3 specialists who do nothing but close.

The challenge: inside sales reps weren't in the living room. They don't know what the tech or comfort advisor said, what objections came up, or what mattered most to the customer. Without that context, they're just another voice calling to "check in."

This is why the handoff matters so much. If the inside sales rep has real context—the specific objections, the financing conversation, who the decision-makers were, what the customer was comparing—they can have a substantive conversation. If all they have is "quoted $12,400, customer said 'let me think about it'"—they're calling blind.

When it works: Operators with enough volume to justify dedicated headcount. Shops with a clear handoff process from field to inside sales. When inside sales has real context from the in-home conversation.

Common mistakes: Building an inside sales team without solving the context problem. No clear ownership windows or handoff triggers. Measuring activity (calls made) instead of outcomes (estimates closed).

The Hybrid Approach: Ownership Windows + Handoffs

The most sophisticated operators we've seen don't pick one model—they build a system that combines them.

A common structure:

0-48 hours: Tech or comfort advisor owns the lead. They have context, they have rapport, and they have the best shot at a quick close.

48 hours - 7 days: If the tech hasn't closed, the lead hands off to inside sales or a dedicated follow-up team. The key: the handoff includes context from the original appointment, not just CRM notes.

7-30 days: Inside sales continues to work the lead with multi-touch follow-up—calls, texts, emails. They're armed with the specific objections, financing details, and decision-maker dynamics from the original conversation.

30+ days: Leads enter a longer-term nurture sequence. Marketing automation, seasonal promotions, maintenance reminders. The goal is to stay top-of-mind until the customer is ready.

The specific timelines vary by operator. Some give techs 24 hours, not 48. Some extend inside sales ownership to 60 or 90 days. The point is: there's a defined process with clear ownership at each stage.

The Real Question: Context

The tension between these models isn't really about who makes the call. It's about what they know when they make it.

The tech has context but no time. The GM has authority but no context. The CSR has availability but no depth. Inside sales has scale but—historically—no visibility into what actually happened in the home.

The operators closing more unsold estimates aren't just picking a model. They're solving the context problem. They're capturing what happens in the in-home conversation—the objections, the financing discussion, the decision-maker dynamics—and getting that information to whoever is doing the follow-up.

When the person calling knows the customer was weighing the 16 SEER vs. the 18, and that monthly payments were a concern, and that the spouse wanted to "sleep on it"—that's a different conversation. That's a closeable conversation.

Questions to Pressure-Test Your Process

- Who owns an unsold estimate on Day 1? Day 7? Day 30?

- What triggers a handoff from the tech/CA to the follow-up team?

- What information does the follow-up team have about the original conversation?

- How many touches happen before a lead is marked "closed-lost"?

- Are you measuring follow-up activity—or follow-up outcomes?

No Static Answers

Like most operational decisions, this isn't one-size-fits-all. Some functions benefit from centralization. Others need to stay close to the field. The best operators test, learn, and adjust—pushing functions back to the field when centralization creates worse outcomes, and pulling them to the center when scale creates advantages.

But if your current follow-up process isn't converting, it's worth asking: is the problem effort, or is it information? Is your team calling enough—or are they calling blind?

Craft's AI Sales Engine captures every in-home sales conversation and surfaces the context your follow-up team needs— full customer journey, objections raised, financing discussed, decision-maker dynamics—so whoever makes the call has the full picture. Think of it as a co-pilot for your proposal follow-ups.